The further limits on shipments could cripple Beijing’s A.I. ambitions and dampen revenues for U.S. chip makers, analysts said.

The Biden administration on Tuesday announced additional limits on sales of advanced semiconductors by American firms, shoring up restrictions issued last October to limit China’s progress on super computing and artificial intelligence.

The rules appear likely to halt most shipments of advanced semiconductors from the United States to Chinese data centers, which use them to produce models capable of artificial intelligence. More U.S. companies seeking to sell China advanced chips, or the machinery used to make them, will be required to notify the government of their plans, or obtain a special license.

To prevent the risk that advanced U.S. chips travel to China through third countries, the United States will also require chip makers to obtain licenses to ship to dozens of other countries that are subject to U.S. arms embargoes.

The Biden administration argues that China’s access to such advanced technology is dangerous because it could aid the country’s military in tasks like guiding hypersonic missiles, setting up advanced surveillance systems or cracking top-secret U.S. codes. Leading A.I. experts have warned that the technology, if not properly managed, could pose existential threats to humanity.

But artificial intelligence also has valuable commercial applications, and the tougher restrictions may affect Chinese companies that have been trying to develop A.I. chatbots like ByteDance, the parent company of TikTok, or the internet giant Baidu, industry analysts said. In the longer run, the limits could also weaken China’s economy, given that A.I. is transforming industries ranging from retail to health care.

The limits also appear likely to affect sales to China of U.S. chip makers such as Nvidia, AMD and Intel. Some chip makers earn as much as a third of their revenue from Chinese buyers and spent recent months lobbying against tighter restrictions.

U.S. officials said the rules would exempt chips that were purely for use in commercial applications, like smartphones, laptops, electric vehicles and gaming systems. Most of the rules will take effect in 30 days, though some will be effective sooner.

In a statement, the Semiconductor Industry Association, which represents major chip makers, said it was evaluating the impact of the updated rules.

“We recognize the need to protect national security and believe maintaining a healthy U.S. semiconductor industry is an essential component to achieving that goal,” the group said. “Overly broad, unilateral controls risk harming the U.S. semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere.”

A spokesperson for Nvidia said that the company complied with all applicable regulations and that it did not expect a meaningful near-term effect on its financial results, given worldwide demand for Nvidia’s products.

In a call with reporters on Monday, a senior administration official said that the United States had seen people try to work around the earlier rules, and that recent breakthroughs in generative A.I. had given regulators more insight into how the so-called large language models behind it were being developed and used.

Gina M. Raimondo, the secretary of commerce, said the changes had been made “to ensure that these rules are as effective as possible” and that she expected the rules to be updated at least annually as technology advanced.

Referring to the People’s Republic of China, she said, “The goal is the same goal that it’s always been, which is to limit P.R.C. access to advanced semiconductors that could fuel breakthroughs in artificial intelligence and sophisticated computers that are critical to P.R.C. military applications.”

She added, “Controlling technology is more important than ever as it relates to national security.”

The Biden administration has been trying to counter China’s growing mastery of many cutting-edge technologies by pumping money into new chip factories in the United States. It has simultaneously been trying to set tough but narrow restrictions on exports of technology to China that could have military uses, while allowing other trade to flow freely. U.S. officials describe the strategy as protecting American technology with “a small yard and high fence.”

But determining which technologies really pose a threat to national security has been a contentious task. Major semiconductor companies have argued that overly restrictive trade bans can sap them of the revenue they need to invest in new plants and research facilities in the United States.

Some critics say the limits could also fuel China’s efforts to develop alternative technologies, ultimately weakening U.S. influence globally. Chinese researchers have made significant progress in developing domestic versions of advanced chips, but experts say the country remains years behind Western capabilities.

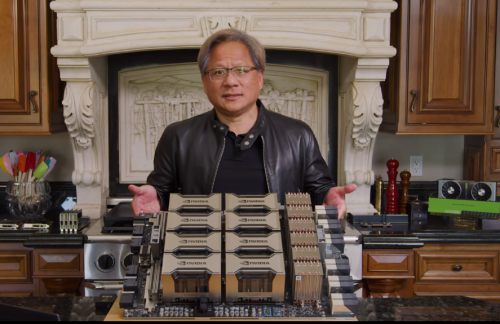

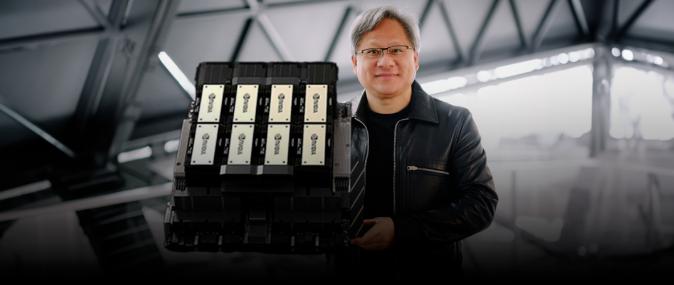

The changes announced Tuesday appear to have particularly significant implications for Nvidia, the biggest beneficiary of the artificial intelligence boom.

In response to the Biden administration’s first major restrictions on artificial intelligence chips a year ago, Nvidia designed new chips, the A800 and H800, for the Chinese market that worked at slower speeds but could still be used by Chinese firms to train A.I. models. A senior administration official said the new rules would restrict those sales.

Nvidia has said that China typically generates 20 percent to 25 percent of the company’s data center revenue, which includes other products in addition to chips that enable A.I. Analysts said that growing global demand for Nvidia chips for use in A.I. might allow the company to offset those losses by selling to other markets instead. But concerns about the impact of new performance limits on a wider set of Nvidia chips caused its stock price to fall more than 3 percent Tuesday.

The administration also placed two Chinese chip design companies and their subsidiaries — units of Moore Threads Technology and Biren Technology — on an “entity list” that requires U.S. companies to receive special permission before they can ship materials to them.

The United States also said it would create a new “gray list” that requires makers of certain less advanced chips to notify the government if they are selling them to China, Iran or other countries subject to a U.S. arms embargo.

“What strikes me is the significant expansion of countries to which exports will now require a license,” said Emily Benson, an analyst at the Center for Strategic and International Studies, a Washington think tank.

The rules did not appear to limit Chinese firms’ access to foreign cloud services run by Amazon and Microsoft. The administration had considered clamping down on that business in recent months because Chinese firms had used such services as a kind of backdoor to access advanced artificial intelligence chips outside of China. But Ms. Benson said such a measure could come later in the form of an executive order.

In a note to clients last week, Julian Evans-Pritchard, the head of China economics at the research firm Capital Economics, said the effects of the controls would become more apparent as non-Chinese companies rolled out more advanced versions of their current products.

“The upshot is that China’s ability to reach the technological frontier in the development of large-scale A.I. models will be hampered by U.S. export controls,” Mr. Evans-Pritchard wrote. That could have broader implications for the Chinese economy, he added, since “we think A.I. has the potential to be a game changer for productivity growth over the next couple decades.”

最新消息,10月17日, 美国宣布扩大芯片和芯片设备出口禁令,计划停止向中国运送由英伟达等公司设计的更先进的人工智能芯片。

新规定改变了限制出口的芯片范围,将纳入数量更多的芯片(详情见文末),英伟达的A800和H800芯片将受冲击。另外,英特尔、超微(AMD)的芯片销售也可能受限,并可能影响半导体设备厂ASML、应用材料、科林研发(Lam Research)、科磊(KLA)的产品卖到中国。

公告显示,新规将于30天内生效,包括伊朗和俄罗斯在内40多国受到限制,并将半导体公司摩尔线程和壁仞智能等13家中国企业列入了黑名单。

美国商务部长雷蒙多表示,新措施弥补了去年10月发布的法规中的漏洞,并且可能至少每年更新一次,主要目标是限制中国获得AI和军事领域的先进芯片,并强调政府无意在经济上伤害北京,中国仍将进口价值数千亿美元的美国芯片。

出口限制扩大至40多国

新措施还扩大向另外40多个国家出口先进芯片的限制,这些国家的企业可能帮助中国绕道,将美国芯片运送到中国。这些国家包括沙特阿拉伯、阿联酋、越南、伊朗和俄罗斯等国家。

这项措施似乎是英伟达在8月收到的一封信函,该信函称该信函限制将其A100和H100芯片从中国出口到包括中东一些国家在内的其他地区。

拜登政府也对中国以外的21个国家提出芯片制造工具出口限令,因为担心这些设备可能被转移到中国以及其他国家安全问题。

拜登政府还在限制进入中国的设备清单中添加了一些浸入式深紫外光 (DUV) 设备,这比先前荷兰规定更严,以阻止荷兰ASML向一些先进的中国芯片工厂发送较旧的DUV型号和备件。

ASML声明中表示,新措施可能会在中长期内对系统销售的区域划分产生影响,但该公司预计不会对其2023年的财务前景产生「实质影响」或更长期。

摩尔线程、壁仞智能拉入黑名单

资料显示,被新列入实体清单的13家实体包括壁仞科技及其子公司、摩尔线程及其子公司、光线云(杭州)科技有限公司、超燃半导体(南京)有限公司。

2021年起,中国为了寻求制裁的突破,开始往Chiplet的方向发展。英伟达和英特尔专门为中国市场开发了特殊的芯片,保留了强大的运算能力,但限制了通讯速度,以保持在以前的规则之内。

美方的新规对一定尺寸的芯片所包含的运算能力进行了限制,这项措施旨在防止使用新的 Chiplet 技术的变通办法。

美方将摩尔线程、壁仞智能列入黑名单,这两家公司都是英伟达前员工创立的新创公司,美国供应商在向其运送产品之前将面临严格的授权许可要求。

壁仞智能坚决反对将其列入黑名单,并将呼吁美国政府重新审查这项决定。摩尔线程强烈不同意将其列入贸易黑名单。

英伟达:这些芯片买不到了

根据英伟达17日提交的监管文件,英伟达表示,新规定可能会影响该公司及时完成某些产品的开发、对这些产品现有客户提供支持、或向受影响地区以外的客户供应这些产品的能力。

英伟达在文件中表示,预期限制措施不会影响短期的财报结果,原因是市场对其芯片的需求强劲。但白宫最新禁令适用于A100、A800、H100、H800、L40、L40S及RTX 4090芯片,也会影响跟上述芯片搭售的系统,当中包括DGX、HGX系统等。

英伟达除了说,新规定可能会延后产品的开发时程外,还表示公司可能被迫把部分业务从一个或更多受影响的国家迁出。